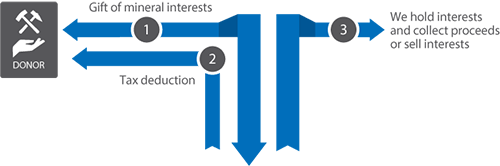

Gifts of Mineral Interests

How It Works

- You donate mineral interests to National Audubon Society.

- We hold the interest and collect the proceeds, or we sell it and apply the proceeds to the purposes you designate.

Benefits

- You make a gift that benefits National Audubon Society.

- You make the gift outright or you may use it to create a life income gift that will pay you or your beneficiaries income for life.

- You are eligible to claim a tax deduction based on the mineral interest's fair-market value at the time of the gift.

- The value of the assets will be removed from your taxable estate.